Professional Affiliation & Membership in UAE

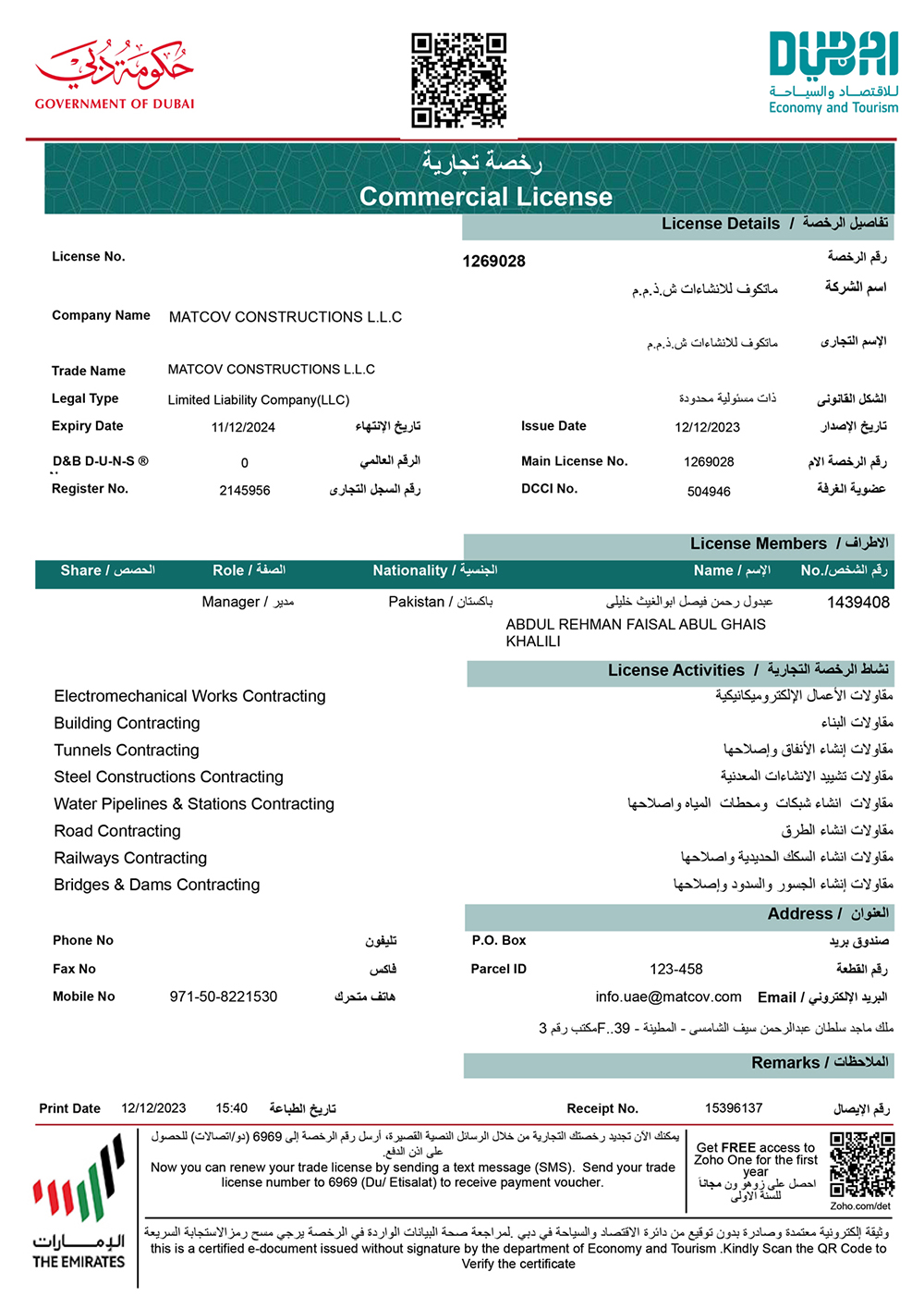

Department of Economic Development, Dubai

Being registered with the DED not only grants businesses the legal authorization to operate but also opens avenues for participation in various economic initiatives and development programs

The Department of Economic Development (DED) in Dubai holds a pivotal legal standing as the primary regulatory body overseeing economic activities within the emirate. Its role extends beyond mere governance, actively fostering a conducive business environment for entrepreneurs and companies alike. For customers, the Department of Economic Development (DED) in Dubai serves as a guardian of their rights and interests within the business landscape.

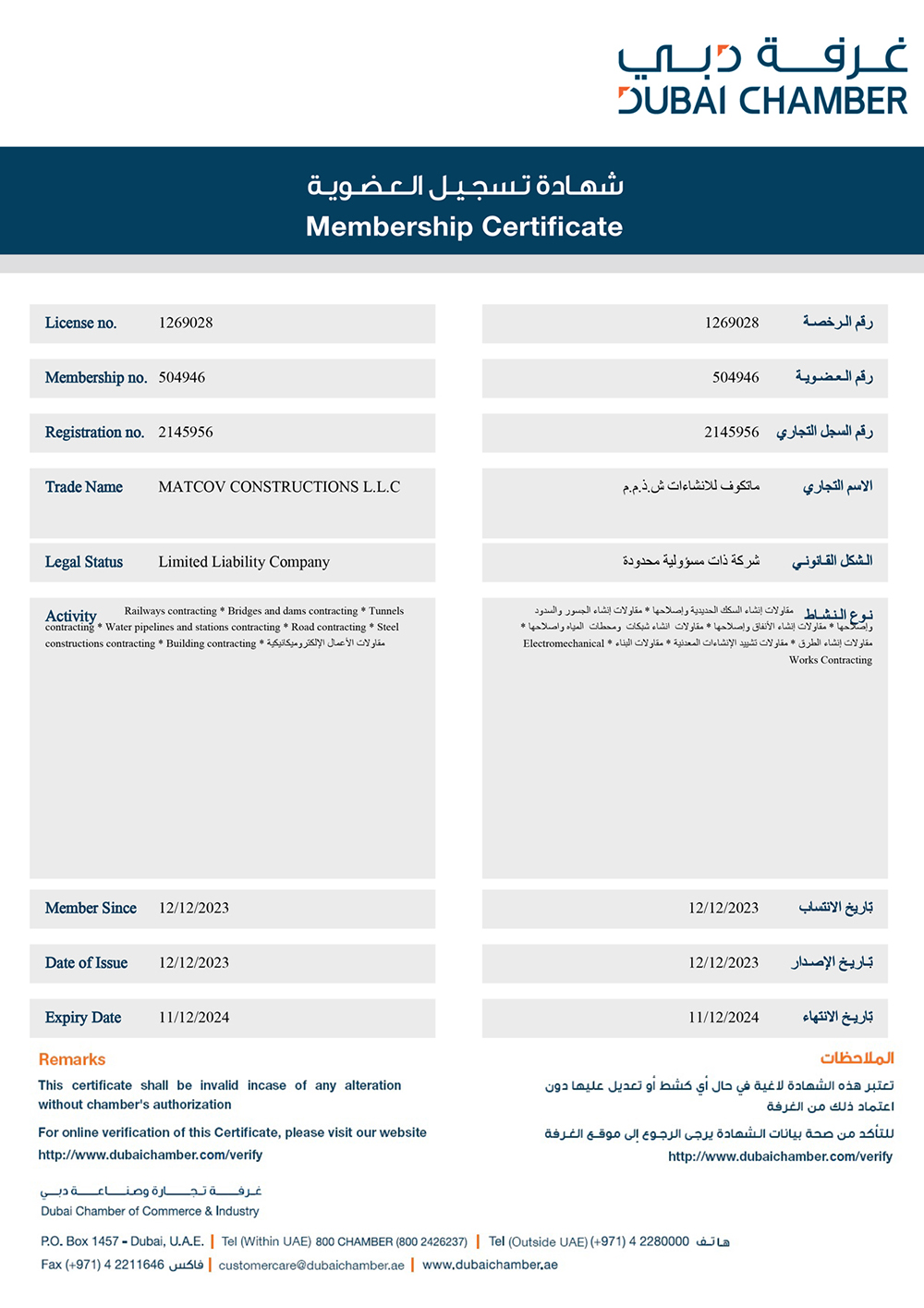

Dubai Chamber of Commerce

Being member of Dubai Chamber of Commerce means unparalleled networking, advocacy, and support services, ensuring growth, credibility, and access to valuable resources, which is beneficial for projects.

Dubai Chamber of Commerce (DCC) is a non-profit organization. It operates as a membership-based entity that facilitates and supports the business community in Dubai. It does so by creating a favorable environment; promoting Dubai as an international business hub and by supporting the development of business. It does so by creating a favorable environment; promoting Dubai as an international business hub and by supporting the development of business.

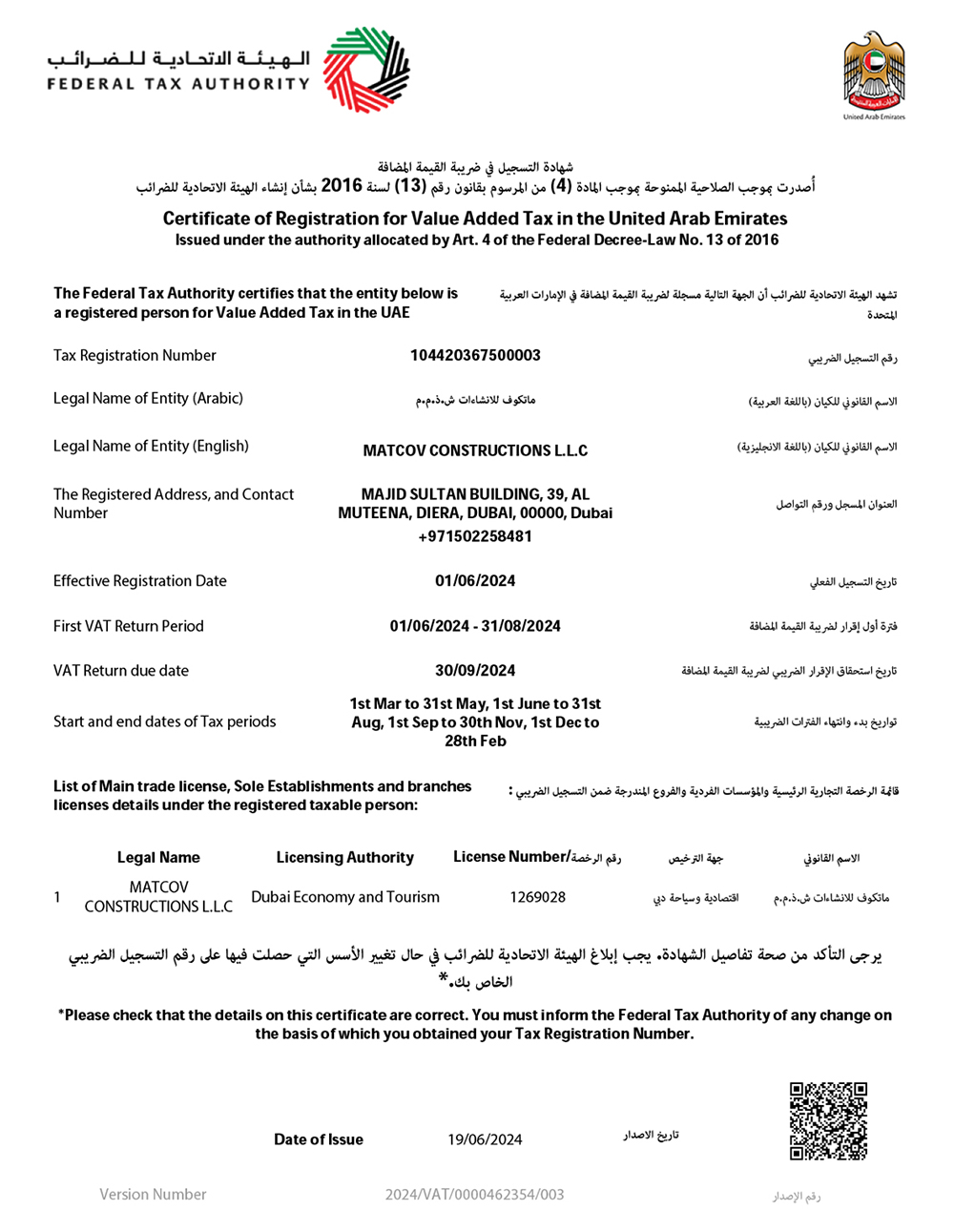

Federal Tax Authority

Having a TRN means the company is registered with tax collecting board of the country and is in strict financial monitoring. Ensures legal compliance and credibility.

The Federal Tax Authority (FTA), the government entity responsible for the administration, collection and enforcement of federal taxes, was established in 2016 by the President of the UAE, His Highness Sheikh Khalifa Bin Zayed Al Nahyan, via Federal Decree-Law 13 of 2016.

Professional Affiliation & Membership in Pakistan

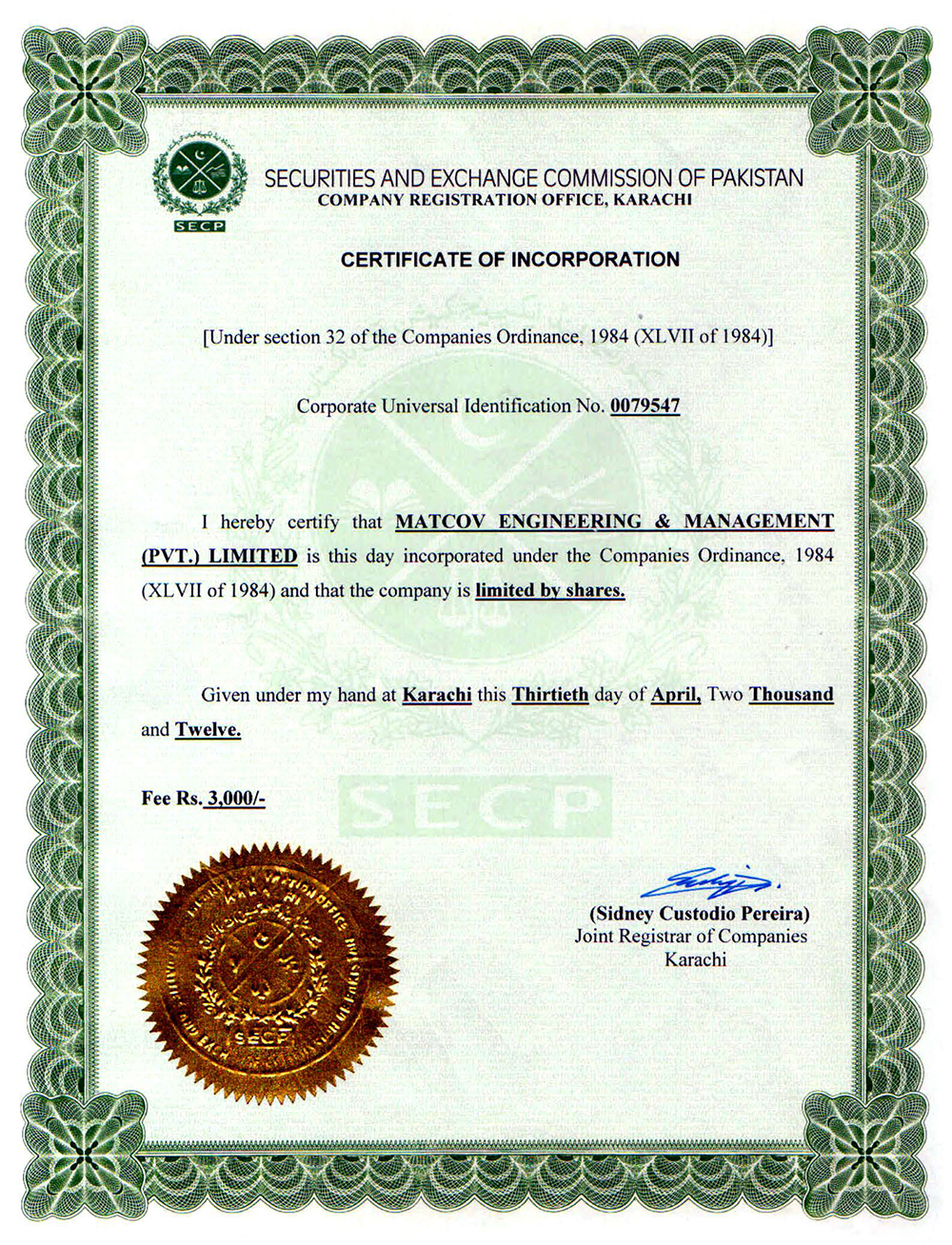

Securities & Exchange Commission of Pakistan

Being registered with SECP means that the business is being run by a proper and legal company bound to follow all prevailing laws with proper checks on it.

Securities and Exchange Commission of Pakistan (SECP) established under the Securities and Exchange Commission of Pakistan Act 1997 was operationalized as a body Corporate on 1st January 1999. To develop a fair, efficient and transparent regulatory framework, based on international legal standards and best practices, for the protection of investors and mitigation of systemic risk. One of the important functions of the SECP is the incorporation/registration of companies.

Pakistan Engineering Council

Having registered in PEC means the company is authorized by Government of Pakistan to practice its engineering in the country.

Pakistan Engineering Council is a statutory body, established in January 10, 1976, constituted under the PEC Act 1976 (V of 1976) to regulate the engineering profession in the country such that it shall function as key driving force for achieving rapid and sustainable growth in all national, economic and social fields. The council sets and maintains realistic and internationally relevant standards of professional competence and ethics for licensed engineers to competently and professionally promote and uphold the standards.

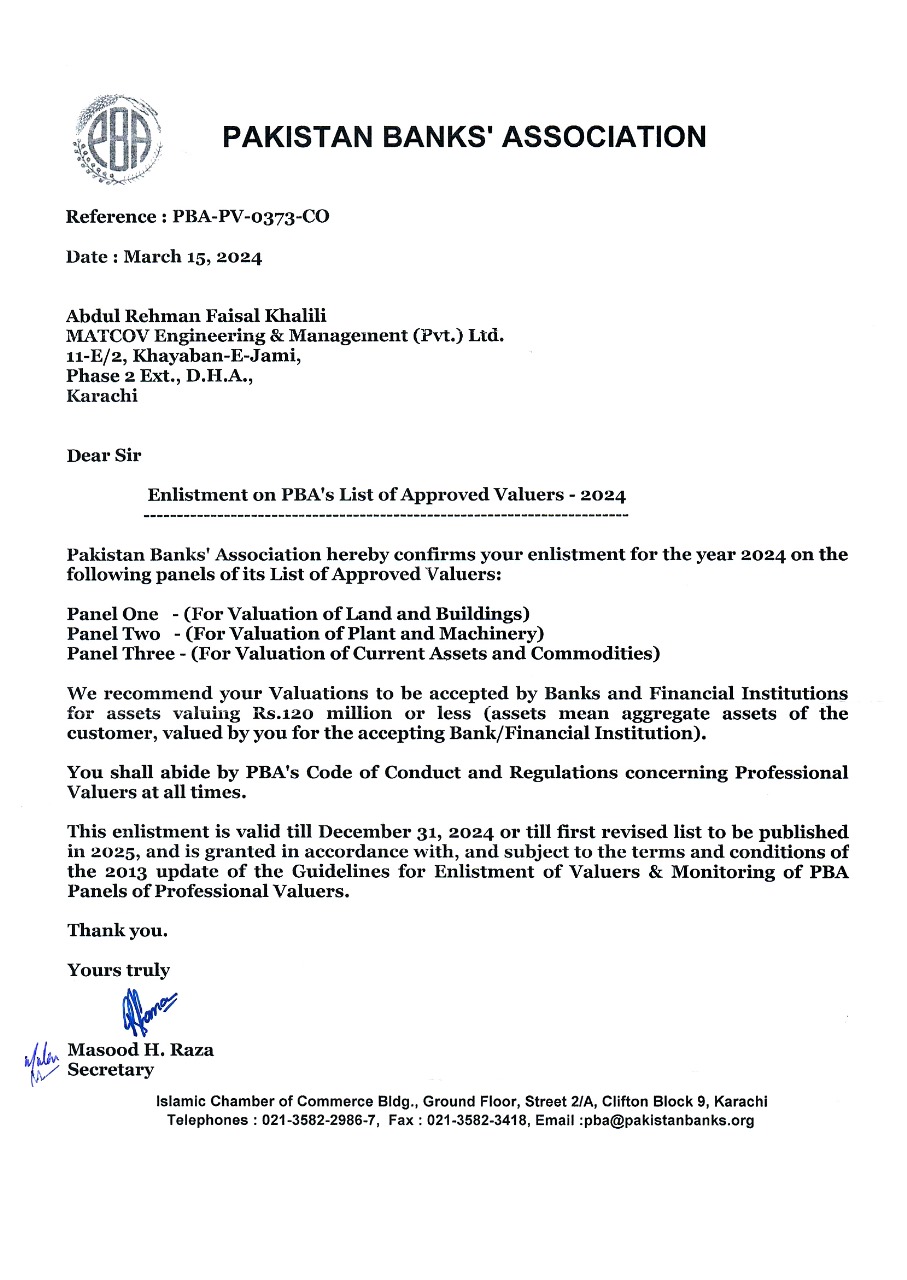

Pakistan Banks’ Association

Being approved by PBA as a professional valuer means that the company is allowed to appraise the values of assets collateralized to banks.

Pakistan Banks’ Association (PBA) represents the Pakistan Banking Industry, established in 1953. It is now referred to by the State Bank of Pakistan in formulation of regulations for the banking industry, and has been entrusted with the function of regulating and monitoring certain services being provided to the banking industry by outside service providers. These service providers include Professional Valuers and Security Agencies offering security services to the Banking Industry.

Registered Tax Payer in Federal Board of Revenue - Sales Tax

Having an STN means the company is registered with tax collecting board of the country, is allowed to do business as a general supplier, and is in strict financial monitoring

Registered Tax Payer in Sindh Revenue Board

Being registered with SRB, means that the company is contributing by paying taxes on its services to provincial

government, and is being monitored.